Based on past patterns, it may be possible to predict the potential outcomes of the upcoming Bitcoin BTC Halving cycle in 2024.

The Bitcoin halving process is a scheduled event that occurs approximately once every four years, or after every 210,000 blocks are mined on the Bitcoin network. Bitcoin is a decentralized digital currency that operates on a distributed ledger technology called the blockchain. In order for transactions to be validated and added to the blockchain, they need to be verified by a network of computers called nodes. These nodes compete with each other to solve complex mathematical puzzles in a process called mining.

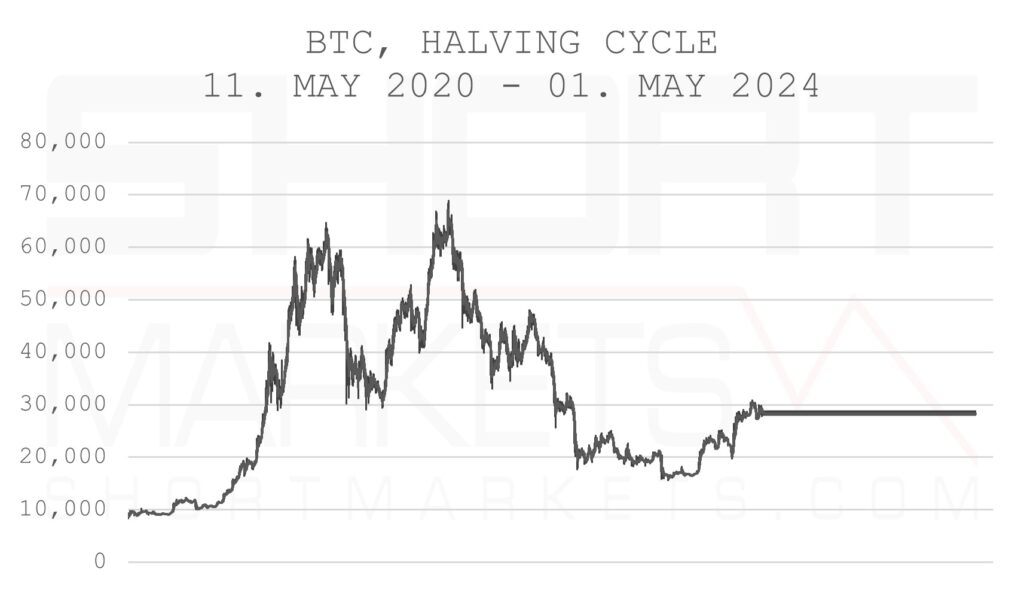

The pic above is showing you BTC development through the 1. real Halving process.

When a node successfully solves a puzzle, it is rewarded with a certain number of newly created Bitcoin. This process of creating new Bitcoin is called mining, and it is what helps to maintain the integrity of the Bitcoin network. However, in order to control the supply of Bitcoin and prevent inflation, the rate at which new Bitcoin is created is designed to slow down over time. This is where the halving process comes in.

At the start of the Bitcoin network in 2009, the mining reward was 50 Bitcoin per block. However, after the first 210,000 blocks were mined, the reward was cut in half to 25 Bitcoin per block. Then, after the next 210,000 blocks were mined, the reward was halved again to 12.5 Bitcoin per block, and so on. The most recent halving occurred in May 2020, after which the mining reward was reduced from 12.5 Bitcoin per block to 6.25 Bitcoin per block.

The purpose of the halving process is to gradually reduce the rate at which new Bitcoin is created, eventually capping the total supply of Bitcoin at 21 million coins. This is a key feature of the Bitcoin network that distinguishes it from traditional fiat currencies, which can be printed or created by central banks at will.

The pic above is showing you BTC development through the 2. real Halving process.

So, why does the halving process matter? The halving process can have significant effects on the supply and demand of Bitcoin, and therefore its price. With the supply of newly created Bitcoin reduced by half, some people believe that this scarcity will increase the value of existing Bitcoin, as it becomes harder to obtain. This has historically led to an increase in the price of Bitcoin after each halving event.

In each of the last three Bitcoin Halving cycles, there has been a significant opportunity for profit as the price has surged from its low point to a high point. Based on these past patterns, it may be possible to calculate and predict the potential outcomes of the upcoming Halving cycle.

Bitcoin has historically increased well over 650% from its low point within its Halving cycle, only to experience a subsequent drop of over 50%. The most recent Halving occurred in May 2020, and the next is scheduled for May 2024. Using historical data, it is possible to estimate that…

…the next low for BTC could occur around May 22, 2024, with a subsequent high between October 4th and October 28th, 2025, before dropping by over 50%.

Based on historical data (see pic 1 and 2 above, 3 below), our calculated research is making it appear unlikely that Bitcoin will experience price increases above 50.000 in 2023. However, a new major bull market is expected to emerge in Q2 of 2024 and continue passed through the entire Q3 of 2025. Of course, the continuation of the current Halving cycle trend cannot be guaranteed.

The pic above is showing you BTC development through the 3. real (ongoing) Halving process.

It is important to note that the price of Bitcoin is influenced by many factors beyond just the halving process, including market demand, investor sentiment, and regulatory changes. Additionally, the halving process is a predictable event that is known well in advance, which means that the impact on the price of Bitcoin may be priced in by investors before it occurs.

The Bitcoin halving process is an important feature of the Bitcoin network that helps to maintain its scarcity and control inflation. While it can have an impact on the price of Bitcoin, it is just one of many factors that influence the value of this digital asset.

As of today, there are 384 day to May 22. 2024.

Happy Halving!

Continue to next Part II here: Crypto Markets vs. BTC Halving: And the Winner Is?

For cooperatives and more, please email short @ shortmarkets.com